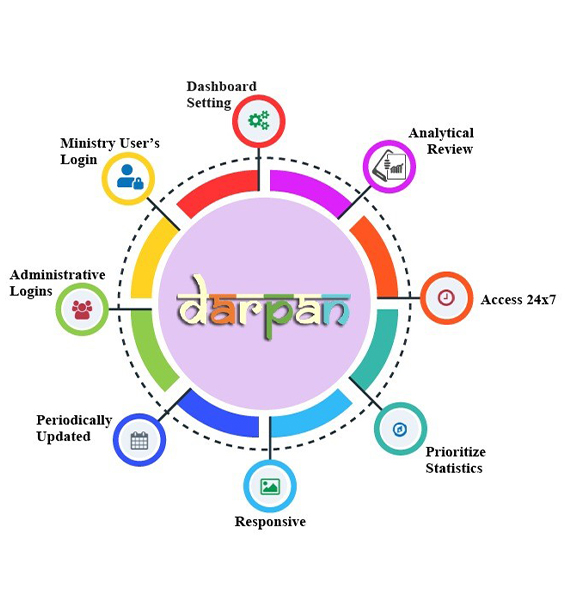

DARPAN is a Dashboard for Analytical Review of Projects Across Nation, transform Complex Government Data into compelling visuals. It gives the technical administration a tool, which is needed to deliver real-time, dynamic project monitoring without coding or programming through web services.

Under Section 12A of the Income Tax Act, 1961, non-profit organizations like charitable trusts, welfare societies, NGOs, religious institutions, etc. are entitled to tax exemptions. This tax relief was introduced, keeping in consideration that non-profit entities work for social welfare and not for generating profit.

Once the Trust organization or NGO is established, they have to register as per Section 12A of the Income Tax Act for claiming exemption under Section 11 and 12 of the Income Tax Act. Section 12A enables non-profit entities such as Charitable Trusts, Non-Profit Organizations, Welfare Societies, Religious Institutions etc to claim full tax exemption as per Section 11 and 12 of the Income Tax Act, 1961. The non-profit entities do not work for profit, rather for the welfare of the people and the society, and are hence called non-profit organizations. As their work is considered a selfless act and they essentially do the work that the government ought to do, they are provided with tax exemptions.

If any non-profitable trust or NGO has not registered for 12A, their financial receipts or transactions would be considered as taxable.

Private or family trusts are not allowed such exemptions and cannot obtain 12A registration.

What is the difference between section 12AA and section 12AB? Section 12AA regulates the initial registration of charitable organizations, while section 12AB regulates the re-registration and operation of existing organizations

Under Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions. Thus, you can claim tax deductions in Section 80G apart from Section 80C and save maximum taxes.

Section 80G of the Income Tax Act, 1961, allows taxpayers to save tax by donating money to eligible charitable institutions. By donating to eligible institutions and organizations, taxpayers can claim deductions ranging from 50% to 100% of the amount donated. However, there are certain limits and conditions that need to be fulfilled to avail of these deductions. Let us examine in detail how Section 80G can help in tax saving and its various nuances.

The 80G Certificate is granted to encourage the donors to donate funds into such non- profit organizations. Furthermore, the donor gets a tax exemption of 50% when they make donations to such organization, as they become eligible to deduct such amount from their Gross Total Income.

The 80G Certificate, issued by the Income Tax Department, is a recognition given to non-governmental entities like charitable trusts or Section 8 Companies. Its primary purpose is to incentivize donors to contribute funds to these non-profit organizations

When the NGO gets enlisted under section 12A, the entire tax of the charitable firm is exempted throughout lifetime. If it gets registered under section 80g, then the donor gets 50% tax rebate of donated amount while giving donation to that NGO.

The Principal Commissioner of Income Tax (PCIT) or Commissioner of Income Tax (CIT) on receipt of an application in Form No. 10A shall pass an order in writing granting an approval in Form No. 10AC. A 16-digit alphanumeric unique registration number (URN) will be issued to an applicant

Corporate social responsibility (CSR) is a business model that helps a company remain socially accountable to itself, its community, and its stakeholders. This business model strives to leave a positive impact on the world, whether for the sake of society, the economy, or the environment.

Corporate social responsibility (CSR) is a broad business concept. It usually describes a company's commitment to carry out its business in an ethical way. This means managing their business processes while taking account of their social, economic and environmental impact, and considering human rights

Corporate social responsibility (CSR) is a self-regulating business model that helps a company be socially accountable to itself, its stakeholders, and the public. By practicing corporate social responsibility, also called corporate citizenship, companies can be conscious of the kind of impact they are having on all aspects of society, including economic, social, and environmental.

The Companies Act, 2013 provides for CSR under section 135. Thus, it is mandatory for the companies covered under section 135 to comply with the CSR provisions in India. Companies are required to spend a minimum of 2% of their net profit over the preceding three years as CSR

Legal Entity Identifier : A Legal Entity Identifier (LEI), is a code that is unique to a legal entity such as a Limited Company, Fund or trust or any organization.

What is the LEI ? The Legal Entity Identifier (LEI) is a reference code — like a bar code — used across markets and jurisdictions to uniquely identify a legally distinct entity that engages in a financial transaction.

An LEI number is used in financial transactions, such as trading stocks, bonds, or currency. LEIs are required by firms to fulfill their reporting obligations under financial regulations and objectives. They also help to match and aggregate market data for transparency and regulatory reasons.

International Organization for Standardization (ISO) certification establishes credibility and trust among consumers, clients and other business partners. In today's international marketplace, such a designation validates that an organization adheres to global standards of quality assurance, manufacturing and business

ISO Certification – ISO Meaning is International Organization for Standardization. ISO Certification give assurance that organization is maintaining and continual improving it’s system as per international accepted standard. It is international accepted arrangement of different rule for all types of organization. ISO have different types of standards according to nature of organization such as ISO 9001:2015 – Quality Management System, ISO 22000:2018 – Food Safety Management System, ISO 27001:2022 – Information Security Management System, ISO 21001:2018 – Educational Management System, ISO 20000-1:2018 IT

Service Management System. For more information what ISO Standard is applicable on your organization.

First of all please note: if you get ISO Certificate for any purpose then be assured ISO Certificate should be IAF – International Accredited Forum (www.iaf.nu) accredited. Every countries government is member of IAF including government of India. Therefore only IAF accredited ISO Certificate is authorized, valid and accepted everywhere at national or International for all purpose like tender, marketing, export etc. Logo and website is given as below: